The Nigerian capital market will be transformed this Friday, 28 November, as it moves to the settlement on the second business day after trading, T+2. The market is currently on T+3 (settlement on the third day after trade), apart from fixed income securities and commodities which already settle on T+2.

The change to the settlement cycle affects secondary market transactions on the Nigerian Stock Exchange (NGX), the NASD OTC Securities Exchange / and the Lagos Commodities & Futures Exchange (LCFE).

According to the Circular from the Securities and Exchange Commission of Nigeria, the change affects the equities market: “The Commission expects this migration to have a significant impact on the profile of the Nigerian Capital market by enabling:

- Improved Liquidity: An expedited settlement process, which allows investors to access their funds more quickly and enhance overall market liquidity.

- Risk Mitigation: Reduction of exposure to counterparty risk, thereby contributing to a more stable and resilient market.

- Global Alignment: Alignment with international best practice, which repositions Nigeria as a more competitive and attractive destination for both domestic and foreign investors.

The first transactions on the T+2 will be those that happen on 28 November. Payment will be transferred from buyer to seller and title of owning the securities will be transferred from seller to buyer on Tuesday 2 December.

The SECN adds: “All market participants, including brokers, dealers, broker/dealers and custodians, are required to update their systems and processes to ensure the effective implementation of the new settlement cycle. Investors are advised to consult with their brokers and investment advisers to understand how the new settlement cycle may impact their transactions and investment strategies.”

The website of the Central Securities Clearing System PLC gives helpful detail. The CSCS says: “By reducing the time between trade execution and settlement, Nigeria’s market becomes more competitive, liquid, and resilient. This upgrade reflects the commitment of regulators, exchanges, and financial institutions to modernize Nigeria’s capital markets, improving investor confidence and reducing risks associated with delayed settlements.”

Rationale for reducing the settlement cycle

According to CSCS “Nigeria is adopting the T+2 settlement cycle to:

- Align with global standards: Major financial markets already use a T+2 or faster cycle for settlement of capital market transactions.

- Improve market liquidity: Faster settlement reduces counterparty risk and frees up capital quicker for reinvestment.

- Enhance investor confidence: A shorter cycle minimizes price fluctuations and uncertainties between trade and settlement, thus boosting investor confidence.

- Boost competitiveness: Attracts more foreign and domestic investors by meeting international standards and increasing operational efficiency.

Key Benefits for Investors

“The transition to T+2 settlement brings significant advantages to all players in Nigeria’s capital markets—enhancing efficiency, reducing risks, and improving overall market confidence. Below are the key benefits for different market participants:

- Get funds/securities 1 day faster

- Less risk of price changes before settlement

- Easier reinvestment with quicker access to cash”.

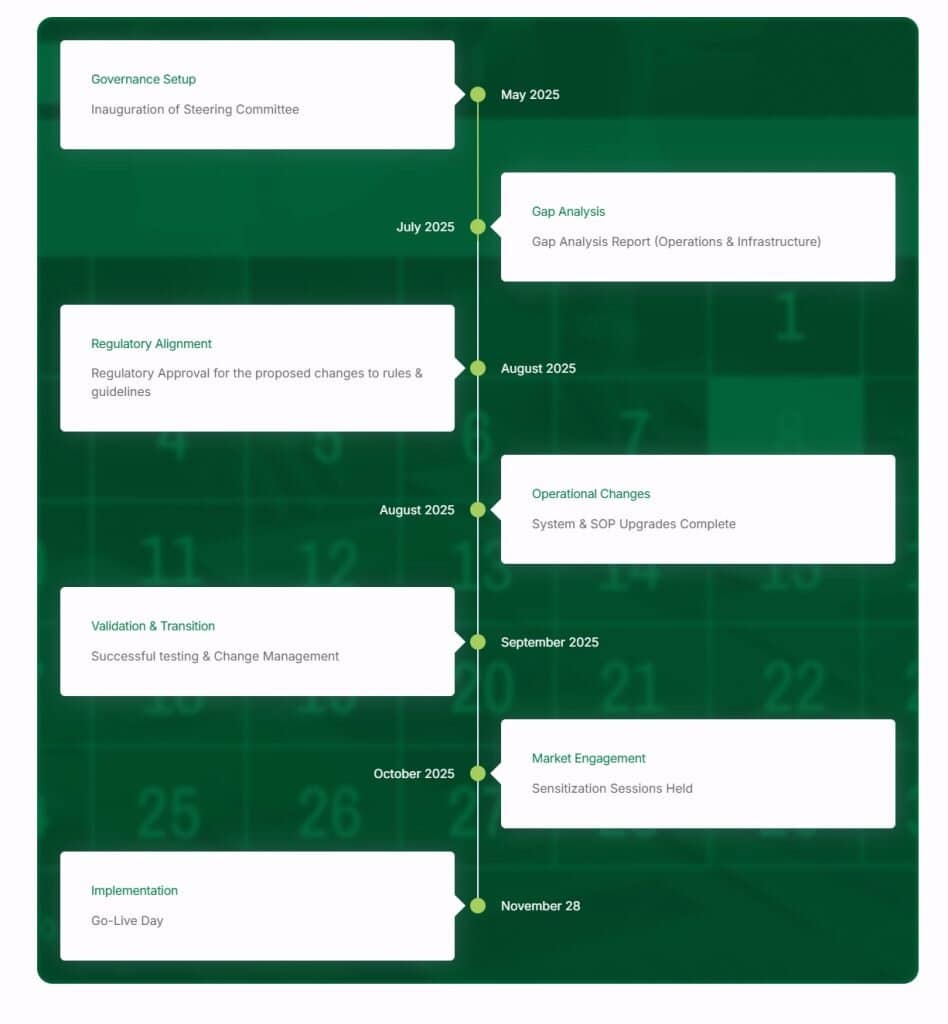

The page also has a fascinating graphic showing how the movement to change was formalized in May 2025 and is being actioned only six months later.

Source: website of Central Securities Clearing System

According to this story on African Markets: “This change also reflects an effort to align Nigeria with global standards. Most major markets across Europe, Asia, and emerging economies already operate on T+2 — and some have even moved to T+1. By taking this step, Nigeria signals its intent to integrate more deeply into the global financial system, attract a wider pool of investors, and enhance the competitiveness of the Lagos financial hub relative to other African and international markets.

“In short, this is more than a procedural update — it’s a strategic move toward a faster, more reliable, and globally aligned Nigerian capital market.”

The Nigerian Exchange started in 1960 as the Lagos Stock Exchange. SECN registered the two over-the-counter markets NASD OTC Securities Exchange and FMDQ in 2012 and the equities exchange became operational in 2013. The LCFE received its licence in 2019 and held its first trades in 2021.