(NOTE: This post is for news information only and does not constitute investment advice in any form)

UPDATE: Ellah Lakes has extended its share offer to 19 December in an announcement on 5 December. It says “Ellah Lakes notes that extending the Offer period will allow more investors to participate”. See below for comment.

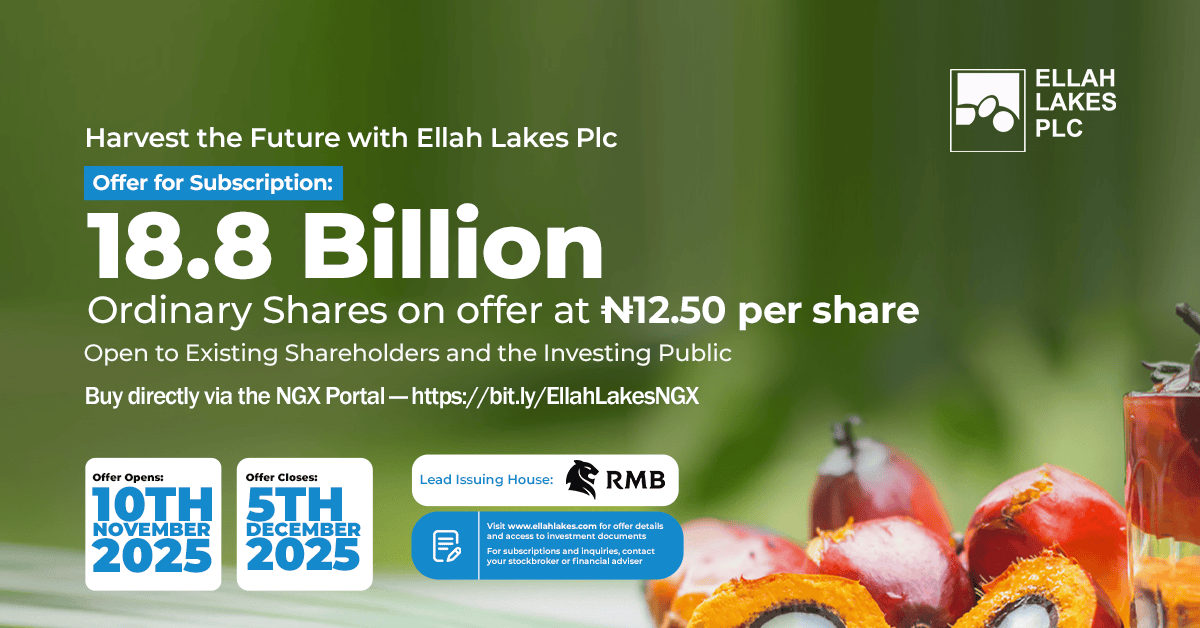

Nigerian integrated agricultural business Ellah Lakes Plc is due to close its NGN 235 billion ($162 million) share offer tomorrow, 5 December, after opening it on 10 November.

Ellah Lakes is issuing 18.8bn ordinary shares of 50 kobo each at N12.50 per share. The company has been listed since 1993 and the share price had climbed from NGN 11.05 before the offer to NGN 14.60 at the close of trading on 3 December and NGN 13.14 on 4 December, although still well behind its NGN 19.42 high of the last 12 months.

It is a major increase to the existing equity capital, which was just under 3.9 bn shares before the offer. The market capitalization is set to increase from NGN 48.2bn before the offer (at the offer share price) to NGN 283.2bn. The offer documents can be found on the investor page of Ellah lakes website. In case of oversubscription, the company can issue up to 15% more shares.

Investor applications are through the NGX Invest e-offer portal or through receiving agents. Applications must be for a minimum of 500 ordinary shares and in multiples of 100 shares after that. The new shares will be treated the same (pari passu) with the existing shares. The allocation statement is timetabled to be published on 19 December and the aim is to list on 21 January.

What will the funds be used for?

According to the abridged prospectus, the offer will “raise funds for both organic and inorganic growth, capital expenditure, and working capital requirements aimed at meeting existing unmet demand and enhancing operational efficiency”. The sum is broken down as NGN 155bn to acquire an oil palm plantation, NGN 45bn for a processing plant to produce High-Quality Cassava Flour (HQCF), NGN 8bn for each of a oil palm mill and a piggery, and NGN 16bn for working capital.

Ellah Lakes aims to buy Agro-Allied Resources & Processing Nigeria Limited (ARPN) which the company describes as “a transformational step to accelerate its growth strategy.” This will add 10,400 hectares of uncultivated land and the company will introduce “high-demand crops and processed food products to expand revenue”.

An article on Nairametrics says ARPN “controls over 22,000 hectares of land, has processing infrastructure in place, and maintains supply relationships, most notably with Dufil Prima Foods, one of the largest FMCG (fast-moving consumer goods) groups in Nigeria.” It says ARPN revenue for the last 12 months was NGN 1.62bn and it made NGN 335m profit. “ARPN is forecast to deliver N2.25 billion in tax-adjusted EBIT and N2.74 billion in free cash flow by 2026, with revenue projected to reach N76 billion by 2030.”

The share offer is led by Rand Merchant Bank Nigeria as lead issuing house and the joint issuing houses are ACQ Capital Managers, Comercio Partners Capital, FCMB Capital Markets, GTI Capital, Lighthouse Capital, MBC Securities and SCM Capital.

According to the financial summary, Ellah Lakes had no revenue for 3 years to 31 July 2023, and than made only NGN 08m revenue in the year to July 2024, and scaled that up to NGN 67.1m in the year to 31 July 2025. How ever, it has been making losses every year while building up its total assets, including by planting and growing oil palm plants. Total assets stood at NGN 31.1bn in July 2025, while it had NGN 7.5bn to cover retained total losses of NGN 5.6bn and reflected in NGN 7.5bn of debt, as at 31 July 2025. One outstanding court case is also mentioned.

Ellah Lakes launched in 1980 to focus on fish farming. It became a Plc (public liability company) in 1992 and in January 1993 it listed its shares for trading on the Nigerian Stock Exchange. It stopped fish farming in 2016 due to persistent security challenges in the Niger Delta, and in May 2019 it acquired Telluria Farms and transformed into a large-scale producer of staple crops and agro processing and it currently focuses on cassava, maize and oil palm. It has been building its land holdings since 2020 and is aiming to grow to 30,000 hectares in Nigeria and Ghana.

Comments and valuation

Punch newspaper’s Oluwakemi Abimbola reported on a presentation at the NGX, where Chuka Mordi, CEO of Ellah Lakes, said: “This offer for subscription is about unlocking the next chapter of Ellah Lakes’ growth story. At an offer price of N12.50 per share, this raise reflects the intrinsic value of our scaled, integrated platform. We are inviting investors to participate in a clear growth trajectory built on over 30,000 hectares of resilient, diversified assets and strong processing capacity.”

Paul Farrer, Deputy Managing Director of Ellah Lakes, said: “Every naira from this raise has a clear strategic purpose. The proceeds will accelerate integration of the newly acquired Agro-Allied Resources & Processing Nigeria Limited assets and upgrade our crude palm oil and cassava processing facilities. Our goal is to deliver a step-change in operational efficiency and scale, maximising value for shareholders..”

Jude Chiemeka, CEO of the NGX, praised Ellah Lakes for leveraging the Nigerian capital market: “At NGX, we are particularly pleased to see a leading indigenous agribusiness like Ellah Lakes harness the market to scale its operations and deepen value creation across the agricultural value chain. This offer represents not only an opportunity for investors to participate in the country’s agro-industrial expansion but also a strong signal of renewed confidence in the Exchange as a gateway for transformative capital formation.”

The NGX said it is committed to deepening access to long-term financing for businesses driving Nigeria’s real sector growth.

The Nairametrics article by Idika Aja goes into more depth on whether the right price, over NGN 200bn, is being paid for ARPN: “Yes, ARPN became profitable in 2025, but it is still an early-stage operation, and the price reflects a lot of optimism about its future. There is also the cost of capital to consider.. In short: the deal makes strategic sense, but the price and performance expectations leave very little room for mistakes.”

Comment on offer extension, Rob Stangroom, investor relations expert and publisher of African Financials, commented on LinkedIn: “When an IPO or public offer is extended, it is typically a sign that the book is not yet fully subscribed. This is not always negative, but it is material information. Investors – especially retail participants – rely on the issuer and its advisors to communicate clearly because they do not have access to real-time book-building data…In the case of Ellah Lakes, several factors intensify the need for clarity: The transaction aims to raise US$165m, a very large amount relative to its existing size. The IPO is not underwritten, which significantly increases risk for retail investors.”