Morocco’s Bourse de Casablanca (Casablanca Stock Exchange) is dynamic for capital raising this year. Its first listing of the year was oversubscribed 64 times. Fintech Cash Plus is running its initial public offering (IPO) until 25 November, and Société Générale des Travaux du Maroc (SGTM) is to follow with an IPO open from 1 to 8 December. The listings and IPO pipeline indicates the success of structural reforms to boost the Moroccan capital market and attract more domestic and foreign capital as the economy is boosted by massive investment.

Cash Plus IPO in progress

Local fintech firm Cash Plus is currently busy with its IPO (see website here), running from 19 to 25 November. The IPO was approved by the regulator Autorité Marocaine du Marché des Capitaux (AMMC – Moroccan Capital Markets Authority) on 31 October and it plans to list on the “Principal F” compartment of the Casablanca Bourse on 8 December.

Cash Plus is offering 3.8m shares at a MAD 200 each, raising a total of MAD 750 million ($81m). These are made up of 2m new shares and the sale of 1.8m existing shares. It includes 5% of shares to company employees at MAD 160 each, and 38% reserved for the general public, while the bulk of the offer is for institutional investors and high-net worth individuals buying a minimum of 15,000 shares each,

The company was founded in 2004, and the share offer permits investors to participate in a key player in financial services accessibility in Morocco. Cash Plus claims 2m daily users in Morocco and net profits of $23.5m according to this story on African Business website.

It has an extensive nationwide network and offers money transfers, bill payments, foreign exchange and payment accounts. It is developing digital tools to make everyday financial services more accessible and offers services and parcel delivery through a network of physical branches and a mobile app. It aims to use the IPO proceeds to accelerate into mobile and online platforms.

According to this article on Morocco World News it operates nearly 5,000 points of sale in Morocco, nearly a quarter of them in rural areas, and employs over 1,500 people. The report quotes Nabil Amar, CEO of Cash Plus: “This operation at the Casablanca Stock Exchange is not an end in itself, but a natural step in an important, sustainable, and transparent growth process.

“We wish to involve all Moroccans, whether they are small shareholders, institutional investors, private investors, or family offices. Most importantly, we want to include every Moroccan who has never invested in the Casablanca Stock Exchange in a national venture of inclusive digitalization.”

SGTM IPO coming 1 December

The latest IPO to be approved by the AMMC is Société Générale des Travaux du Maroc (SGTM), which is offering 20% of the share capital, representing up to 12 million shares with a nominal price of MAD 20 each. The maximum that can be raised is MAD 5.04 billion ($542m). The subscription period is 1-8 December 2025.

The AMMC officially approved the IPO Prospectus on 17 November. The group plans to list on the main market of the Bourse de Casablanca on 16 December. The IPO prospectus includes the offering memorandum and financial figures for the 2024 financial year and the first half of 2025. The documents are available here.

The offering share price varies depending on the investor category: MAD 340 ($36.56) per share for Order Type I (eligible employees and retirees), MAD 380 for Order Type II and MAD 420 ($45.17) for qualified investors under Order Types III and IV.

SGTM has created an offer website, available here. It was founded in 1972 by businessmen Ahmed and M’hammed Kabbaj (according to this Ecofin news agency story) and has completed over 1,000 flagship projects including bridges, roads, ports, airports, hospitals, stadiums and industrial facilities. It employs more than 21,000 people and runs a fleet of 2,500 machines. It also operates in six other African countries: Senegal, Côte d’Ivoire, Burkina Faso, Cameroon, Benin, Tanzania and Guinea.

The prospectus highlights a robust pipeline of contracted projects for the coming years, both in Morocco and in several other African countries where it already has presence.

SGTM views this IPO as a key step in its long-term development and strategy. It will use this to strengthen its structure, attract new partners, improve transparency and enhance its visibility both nationally and across the continent. The share offer is also being used to motivate and incentivize employees by involving them in the company’s performance and enabling them to share directly in the value created.

Financial advisor and global coordinator is Attijari Finances Corp. (investment bank of Attijariwafa Bank), lead manager of the placement syndicate is Attijari Intermédiation and co-lead managers are BMCE Capital, Saham Capital Bourse, CFG Bank Capital Markets and Upline Securities.

GPC Carton IPO

Packaging company GPC Carton (GPC Papier et Carton) is also hoping for approval from the AMMC for its IPO plans, according to this story on Daba Finance.

The new listing is expected to be attractive in the way it combines industrialization with sustainability credentials. In July GPC Carton raised MAD 250m ($27m) through a green securitization fund called FT Novus Green Pack which GPC created to finance its expansion into eco-friendly packaging. It uses commercial receivables as a backing for the financing.

The company is owned by Ynna Holding, a multinational corporation in real estate, supermarkets, hotels and industries, founded by the late Miloud Chaabi and previously called Groupe Chaâbi (Ynna is “my mother” in the Amazigh language, see this family business histories website). Ynna Holding has committed MAD 800m ($86m) to expand its capacity. Plans include a new paper and cardboard recycling plant in Kénitra, which will cut dependency on imports. Studies are also underway on a possible MAD 180m new packaging plant planned for Meknès.

Morocco is enjoying fast growth in its packaging and, according to Daba Finance, production has doubled in the last 15 years and reached MAD 7bn in revenue in 2023. Growing demand comes from agri-food companies and in 2024 Morocco became the leading exporter of corrugated papers and cartons in the Middle East and North Africa (MENA region), highlighting the regional competitiveness of its businesses.

Vicenne IPO

Healthcare company Vicenne listed on the Principal F segment of the main market on 15 July after a flood of demand for its IPO, which was oversubscribed 64 times, with MAD 32bn pledged by 37,674 investors bidding for shares,(ncluding 36,777 individuals and 402 institutional investors. (Bourse de Casablanca links for further information can be found here). The company raised MAD 500m by selling 2.1m shares at a subscription price was MAD 236 per share.

In its press kit, the Bourse de Casablanca commented : “This operation confirms the Casablanca Stock Exchange’s ability to concretely support the development of Moroccan companies by offering them effective and accessible financing solutions, regardless of their size or sector of activity. It sends a strong signal to the entire entrepreneurial ecosystem, illustrating the central role that the stock market can play in accelerating business growth.

“Vicenne’s IPO highlights the Casablanca Stock Exchange’s structuring role in financing the Moroccan economy. By providing the company with the means to mobilize the resources necessary for its development, it confirms its commitment as a long-term partner for businesses of all sectors and sizes.” (Google translate from French).

It is the second health listing and indicates the exchange’s determination to support sectors that have high impact.

Vicenne, previously called Best Health, was created in 2004. It works to modernize medical infrastructure and improve the quality of care in several African countries by offering equipment and services. Its commitment is based on four core values: innovation, excellence, integrity and service to communities.

It will use the IPO funds to finance an ambitious growth plan based on its “Buy & Build” strategy. It says it has identified a pipeline of opportunities estimated at MAD 700m identified and could allocate up to MAD 1bn for strategic acquisitions, both consolidating its presence in Morocco and extending its expansion into Africa.

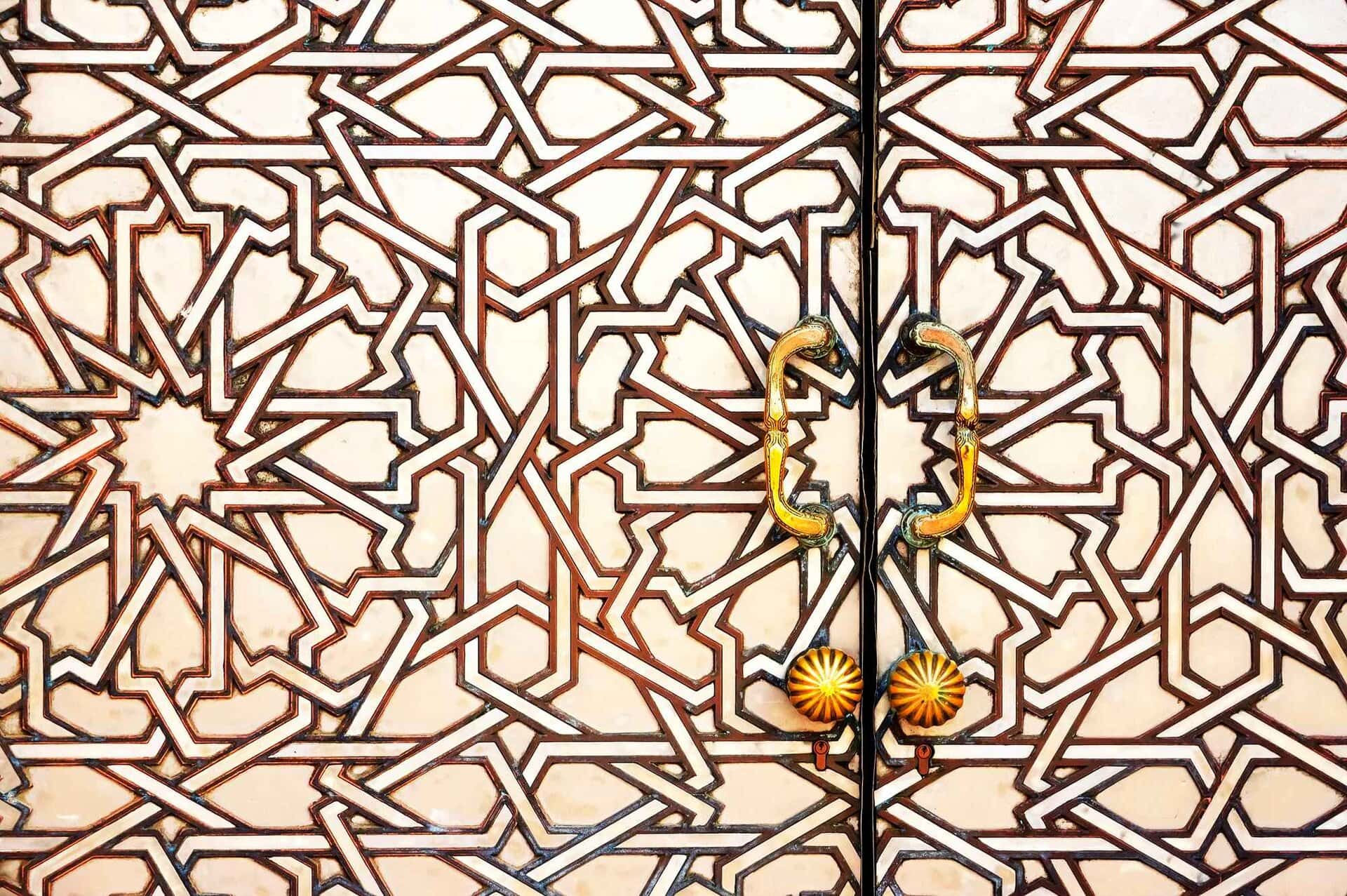

(Photo: Architectural detail in the Hassan II Mosque, Casablanca. Credit Traveler01, Depositphotos).