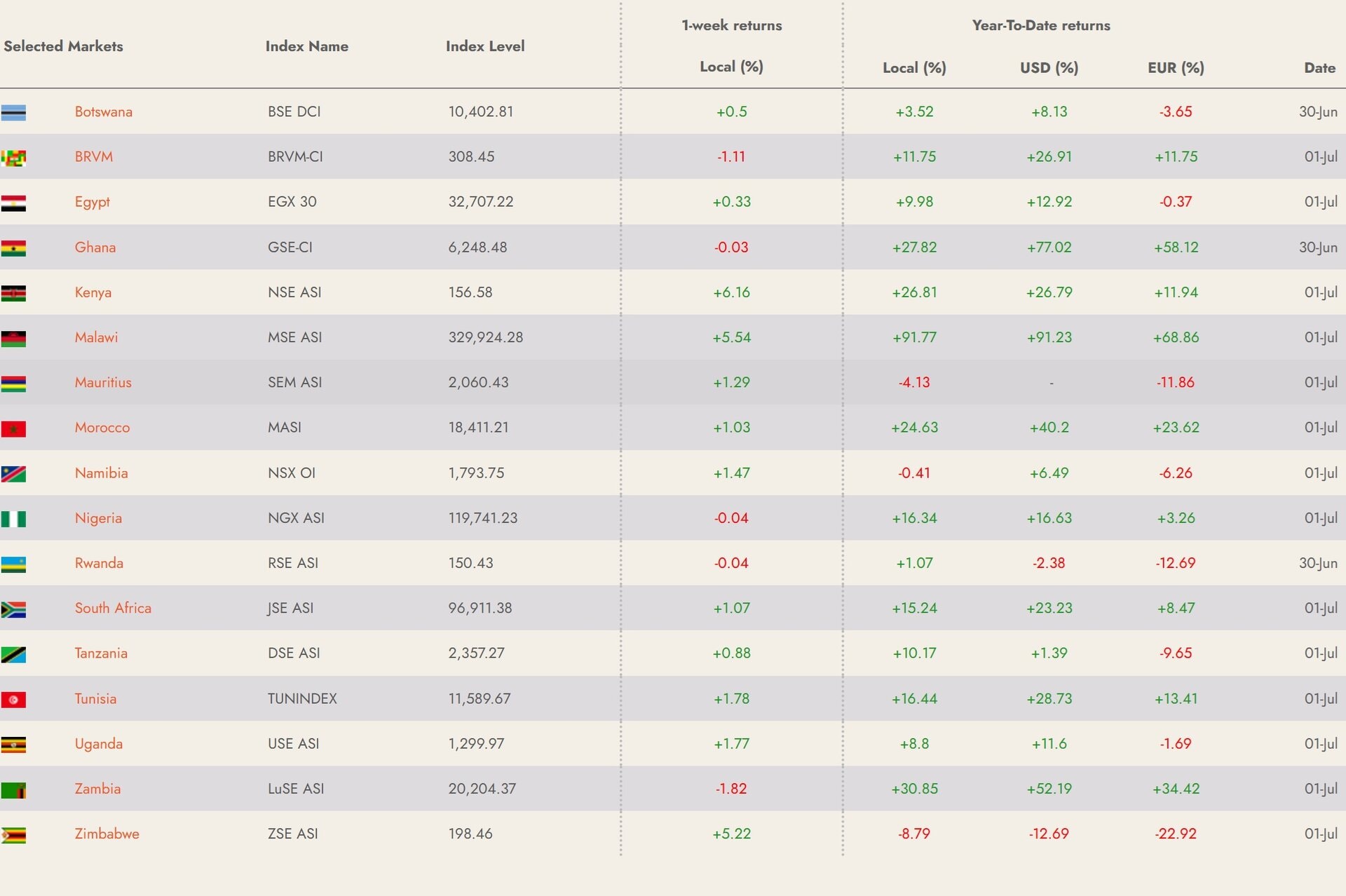

Global investors have enjoyed top-notch returns by investing on many of the African stock exchanges over the first six months of 2025. Returns for investors who measure in USD have been many times higher on leading African stock exchange indices than returns on the US S&P 500 index and other developed markets indices. Local investors have also seen strong returns.

Africa’s top performer is the Malawi Stock Exchange whose all-share index ended 1 July 2025 at 329,924.28, up 91.8% for local investors since 1 January, and up 91.2% for USD investors. Other top performers are Ghana Stock Exchange Composite Index, up 77.0% to investors counting their gains in USD, and up 27.8% to investors counting returns in cedi (GHS ) currency, after the domestic currency also had a soaraway six months.

By comparison, the S&P 500 index of major stocks on US markets has only gained 5.61% in the year to date at the close of 1 July. If an investor had invested $1,000 on 1 January into shares that make up the Malawi ASI index it would be worth $1,912 (not counting dealing costs, etc) at the end of 1 July, compared to only $1,056 by investing into an exchange-traded fund that tracks the S&P 500.

Other top-performing African exchange indices are the Lusaka Stock Exchange All-Share Index, up 51.2% to USD investors and up 30.9% to local investors. The Morocco All Share Index of the Bourse de Casablanca is up 40.2% in USD and up 24.6% in MAD (dirham).

Higher returns in USD compared to local currency returns means that the value of $1 (USD) has fallen compared to the value of the local currency. So far 2025 has been a bad year for USD and there is not much global optimism about prospects for the second half of the year. Ghana’s cedi has been the world’s top performing currency compared to the USD, up nearly 42% between 1 January and 1 July, a big change from 2022 when it fell 55% against the USD.

The dynamic West African regional exchange Bourse Régionale des Valeurs Mobilières (BRVM), headquartered in Abidjan and covering eight countries, is up 26.9% for USD investors and 11.75% to local currency and EUR investors (the CFA/ XOF currency is pegged to the value of the euro).

Tunisia’s TUNINDEX shows 28.7% gain to USD investors and 16.4% for locals. South Africa’s JSE All Share Index is up 23.2% in USD and 15.2% in ZAR local currency.

The only declines for the first half year are the All Share Indices of Rwanda Stock Exchange, down 2.4% to USD investors but up 1.1% to locals, and the Zimbabwe Stock Exchange which is down 12.7% for USD investors and down 8.8% to local investors.

The data is taken from the excellent African Markets website.

Investor interest has been surging in African markets as they pick up momentum after some years of external shocks.

Malawi companies forecast soaring profits

Bernadetta Chiwanda Mia of The Times Malawi reports that local companies have reported soaring profits. National Investment Trust plc (NITL) issued a trading statement on 30 June, available om the MSE website here, that it expects profit-after-tax (PAT) of between MWK 79.6 billion and MWK 80.5bn for the half year to June 2025, up some 1,750% compared to MWK 4.32bn profit in the first half of 2025. “This is mainly due to the strong performance of shares traded on the Malawi Stock Market as reflected by the Malawi All Share Index at 85.83% in 2025 compared to 9.12% in 2024.”

Other profit increases she mentions are: Blantyre Hotels projecting PAT of between MWK 3.35bn and MWK 3.51bn after a loss of MWK 781m in the same period of 2024, with the gain attributed to interest on proceeds from a rights issue for a hotel project.

NBS Bank forecasts PAT of between MWK 70.6bn and MWK 73.8bn (up from MWK32.6bn), FDH Bank plc expects its profit to come out between MWK 57.8bn to MWK 60.8bn (up from MWK 27.9bn in 2024). Nico Holdings anticipates PAT between MWK 115bn to MWK 125bn (up from MWK 49bn). Press Corporation plc projects consolidated profit of MWK 89.3b – MWK 96.0bn, up from MWK 45.28 bn in the corresponding period of 2024.

Table – taken from African Markets website.